The Canadian dollar forecast shows continued strength against the US dollar, with USD/CAD declining 1.5% over five trading sessions. Combined with US dollar weakness from trade tensions and the DXY falling below 100, the CAD outlook suggests further bearish pressure on USD/CAD toward key support levels.

1. Canadian Dollar Forecast Overview

The Canadian dollar forecast for the coming weeks suggests continued strength against the US dollar, with USD/CAD experiencing significant bearish momentum. This comprehensive analysis examines key factors driving CAD strength, technical indicators, and potential risks that could shape the currency pair's trajectory in the coming sessions.

Over the past five trading sessions, the Canadian dollar has gained nearly 1.5% against its US counterpart, driven by shifting monetary policy expectations and broader USD weakness.

2. What's Driving the Canadian Dollar Forecast?

The CAD forecast has turned increasingly positive due to several converging factors that are reshaping market expectations. Understanding these key drivers provides insight into why the CAD has outperformed the USD and what investors should watch for continued momentum.

2.1. Bank of Canada Rate Decision Impact

The CAD forecast has turned increasingly bullish following Canada's latest inflation data release. The year-over-year trimmed CPI reading for April came in at 3.1%, significantly higher than the market expectation of 2.8%. This inflation surprise is reshaping the Canadian dollar forecast and monetary policy expectations.

Market participants now assign a 71% probability that the Bank of Canada will maintain its current rate of 2.75% at the June 4th meeting, with only a 29% chance of a rate cut to 2.5%. This hawkish shift in the CAD represents a departure from previous dovish expectations.

2.2. Canadian Dollar vs US Dollar Dynamics

The benefits from multiple tailwinds:

- Higher inflation readings supporting BoC hawkishness.

- Reduced rate cut expectations making CAD-denominated assets more attractive.

- US dollar weakness creating favorable cross-currency dynamics.

- Safe haven demand amid US trade tensions.

See more related articles:

3. US Dollar Weakness Supporting Canadian Dollar Forecast

The USD/CAD receives substantial support from broad-based US dollar weakness across major currency pairs. Multiple fundamental factors are converging to create headwinds for the greenback, providing a favorable backdrop for CAD strength.

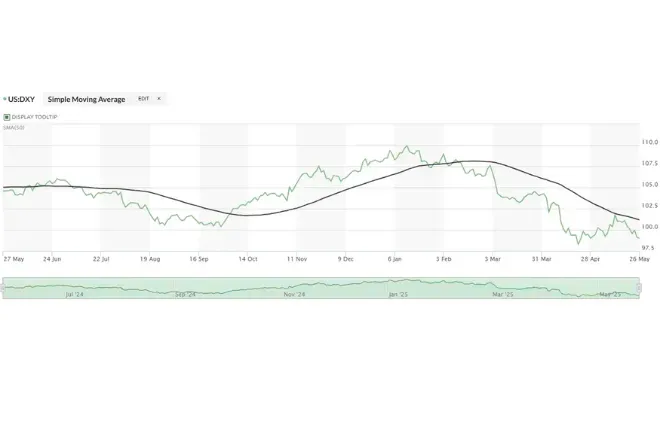

The bearish CAD forecast for USD/CAD receives additional support from ongoing US dollar weakness. The DXY index has fallen below the critical 100 level, reflecting broad-based dollar selling pressure.

Key factors undermining USD strength include:

- Trade war escalation with potential 50% European tariffs

- Geopolitical uncertainty reducing safe haven USD demand

- Risk-off sentiment benefiting alternative currencies like CAD

- Capital flow shifts from USD to other major currencies

4. Technical Analysis: Canadian Dollar Forecast

From a technical perspective, the CAD outlook reveals compelling chart patterns and momentum indicators that support the current bearish outlook for USD/CAD. Key technical levels and indicator signals provide valuable insights for traders and investors positioning for the next move.

4.1. Current Trend Structure

From a technical perspective shows:

- Strong bearish USD/CAD trend established since March 11th.

- No significant bullish corrections challenging the downward structure.

- Accelerating selling momentum in recent sessions.

- Key support levels being tested at 1.36162.

4.2. Technical Indicators

RSI Analysis: A bullish divergence is forming, suggesting the CAD may include short-term technical rebounds as bearish momentum appears overextended.

MACD Signals: The histogram has returned to negative territory, confirming renewed bearish pressure supporting the bullish CAD.

4.3. Critical Price Levels

Resistance Zones:

- 1.40085: 200-period moving average representing distant resistance

- 1.38048: Near-term resistance from recent consolidation zone

Support Areas:

- 1.36162: Key support level from September 2024 lows

5. Canadian Dollar Forecast: Risk Factors

While the Canadian outlook appears constructive in the near term, prudent analysis requires examining potential headwinds that could challenge the current bullish CAD narrative. These risk factors could significantly alter the currency pair's trajectory and require careful monitoring.

5.1. Interest Rate Differential Concerns

While the Canadian dollar forecast appears constructive in the near term, several risks could alter the outlook:

5.2. Interest Rate Differential

Despite recent hawkish shifts in the CAD, US rates remain significantly higher at 4.5% compared to Canada's 2.75%. This 175 basis point differential could eventually favor USD if current risk factors subside.

5.3. Trade Policy Uncertainty

The CAD forecast remains vulnerable to shifts in US trade policy, particularly given Canada's trade relationship with the United States. Any escalation or resolution of trade tensions could impact cross-border capital flows.

6. Canadian Dollar Forecast: Market Outlook

Looking ahead, the forecast presents both opportunities and challenges as multiple time horizons reveal different risk-reward scenarios. Market participants should consider various timeframes when positioning for USD/CAD movements in the coming weeks and months.

6.1. Short-Term Projections

The CAD forecast for the immediate term suggests:

- Continued USD/CAD weakness toward key support levels.

- Potential technical rebounds as RSI divergence develops.

- BoC meeting catalyst on June 4th providing directional clarity.

- US economic data influencing cross-currency dynamics.

6.2. Medium-Term Considerations

Looking ahead, the forecast depends on:

- Inflation trajectory in both countries.

- Central bank policy divergence between Fed and BoC.

- Commodity price movements affecting CAD fundamentals.

- Global risk sentiment influencing safe haven flows.

7. About H2T Finance

H2T Finance’s Market Reports deliver concise, data-driven summaries of the European, American, and Asian trading sessions, alongside weekly analyses and short-term forecasts. Our expert reports cover key currency pairs and price projections, making them an essential tool for traders to make informed decisions and plan their trades effectively. Backed by real market insights and professional commentary, these reports help you stay aligned with market momentum and make smarter trading decisions.

For inquiries or personalized assistance, feel free to contact us:

📞 Phone: +84933.948.888

📧 Email: info@h2tmediagroup.com

💻 Website: https://www.h2tfinance.com/

📍 Address: LV3, 4/567 Tổ 10 Khu Phố Hòa Lân 1, Thuận An, Bình Dương, Vietnam

At H2T Finance, your success is our priority.

The Canadian dollar forecast points toward continued strength in the near term, supported by hawkish BoC expectations and persistent USD weakness. However, traders and investors should remain aware of the significant interest rate differential and potential for technical corrections within the broader bearish USD/CAD trend.

The June 4th Bank of Canada meeting will serve as a critical catalyst for the CAD outlook, potentially confirming or challenging current market expectations. Until then, the path of least resistance appears to favor continued Canadian dollar strength against its US counterpart.

This Canadian dollar forecast of H2T Finance is for informational purposes only and should not be considered as investment advice. Currency markets carry significant risk, and past performance does not guarantee future results. Stay tuned for the latest updates in the Market Reports section to guide your investment decisions.