NZD/USD falls sharply in early European trading on Monday, slipping close to the 0.5900 mark. The decline came despite signs of an improving global trade environment after the US and China agreed to a 90-day truce on tariff escalation.

Contents

90-Day Tariff Pause Fails to Lift NZD

The US and China agreed over the weekend to pause tariff escalation for 90 days and jointly reduce 115% of tariffs, marking a temporary truce in the two countries’ protracted trade conflict. The announcement was made in a joint statement after high-level talks in Geneva, Switzerland.

US Treasury Secretary Scott Bessent highlighted the importance of the deal, saying both countries had demonstrated positive diplomacy and a focus on national interests. He said the 90-day tariff truce was a real step forward in stabilizing global trade tensions.

Meanwhile, US Trade Representative Jamieson Greer acknowledged that the previous strategy of imposing sanctions was unsustainable. He reaffirmed both sides’ commitment to the truce, although some issues, such as fentanyl control, remained unresolved.

Domestic Factors Drive NZD/USD Lower

Despite these positive global developments, NZD/USD falls as investors turn their attention to New Zealand’s weakening economic outlook. The NZD has come under pressure amid growing expectations that the RBNZ will deliver further monetary easing in the coming months.

Recent labor market data has shown signs of weakness, including slowing wage growth and rising unemployment risks. As a result, analysts are largely expecting the RBNZ to cut interest rates by another 25 basis points at its upcoming meeting. Forward guidance suggests the official cash rate could fall to 3% by the end of 2025, with three additional cuts potentially on the horizon.

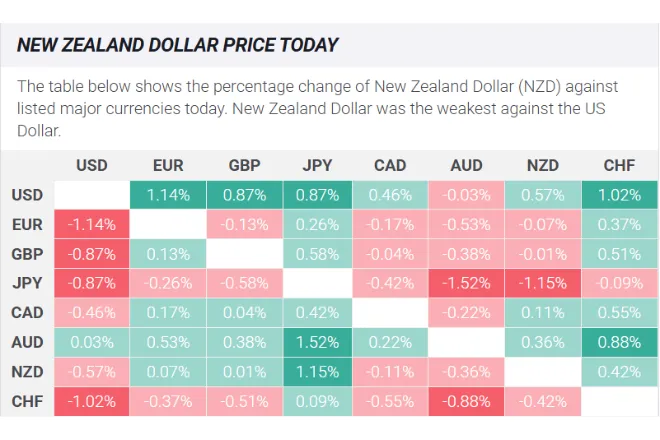

NZD/USD falls: Weakest Among Major Currencies Today

The New Zealand Dollar is currently the weakest-performing major currency against the U.S. Dollar today. While the global backdrop seems more supportive, local economic challenges are dragging the NZD lower, pushing NZD/USD down toward key support near 0.5900.

Key Highlights:

- NZD/USD falls to near 0.5900 during Monday’s European session.

- US and China agree to a 90-day tariff pause and 115% reciprocal tariff cut.

- RBNZ expected to cut rates, citing slowing labor market and inflation risks.

- NZD ranks lowest among major currencies against the USD today.

While the interim deal between the US and China initially boosted global risk sentiment, it was not enough to support the New Zealand dollar. With domestic economic data signaling further softness, NZD/USD falls remain likely in the near term, especially if the RBNZ proceeds with additional monetary policy easing.