The Australian dollar and Chinese yuan surged after easing U.S.–China trade tensions and softer U.S. inflation data. But technical signals suggest the AUD/USD rally may slow if market momentum fades.

Contents

AUD/USD Boosted by Trade Optimism and Weaker US Dollar

The Australian dollar (AUD) and Chinese yuan (CNY) gained strength after positive trade news from the US-China talks. The AUD/USD pair surged as traders reacted to a weaker US dollar (USD) and easing trade tensions. The US announced a 90-day cut to tariffs on Chinese goods, giving markets hope that a longer-term deal could be reached.

Softer US inflation (CPI) data also allowed investors to shift focus to the Federal Reserve’s (Fed) policy path, further weakening the dollar and lifting demand for risk-sensitive currencies like the Aussie.

Chinese Yuan Reaches Six-Month High

The Chinese yuan climbed to its highest level in six months, helping lift the Australian dollar. The yuan’s strength came after a joint statement from the US and China, which improved overall market sentiment. As a result, AUD/USD was the strongest performing major currency on the day.

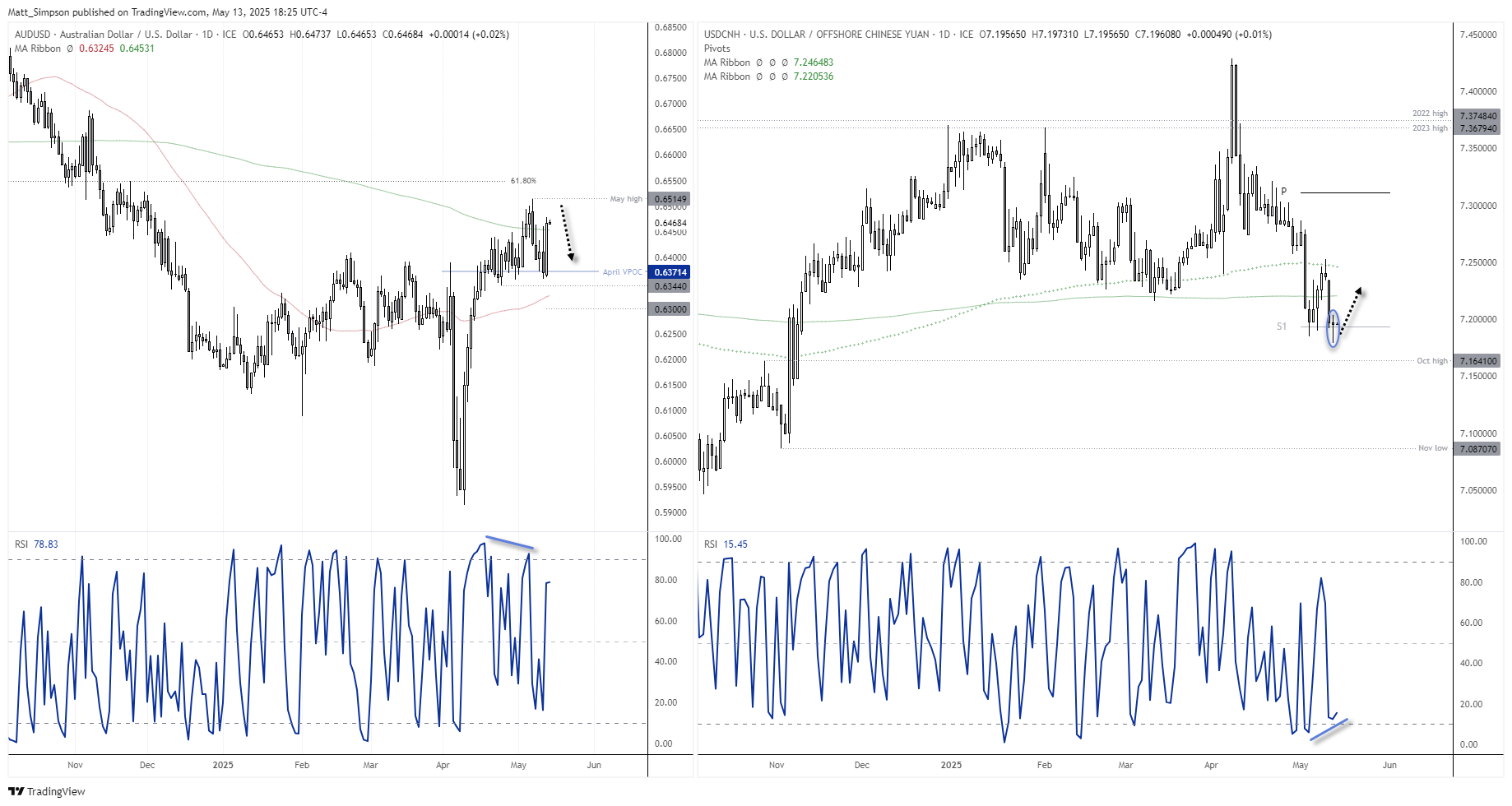

Broader Currency Market Moves

- CAD/USD: The Canadian dollar recovered 0.4% after earlier losses, helped by political developments in Canada.

- GBP/USD: The British pound rose 1%, showing strong bullish momentum.

- EUR/USD: The euro also gained, recovering most of its recent losses.

Stock Market Reactions

US stock indices reacted positively to the trade news:

- Nasdaq 100 and S&P 500 continued to climb.

- Dow Jones fell slightly after hitting resistance.

- ASX 200 futures gained 0.22% overnight but also hit resistance.

See more related articles:

- Trader’s Weekly Outlook: Markets React to US-China Progress and US CPI Data

- AUD/NZD Price Analysis: Bullish Momentum Pushes Pair Near 1.0800 Resistance

- AUD/USD V-Shape Recovery Stalls Below December High: What’s Next for the Australian Dollar?

- AUD/USD Weekly Outlook: Australian Inflation Data to Drive RBA Rate Decision

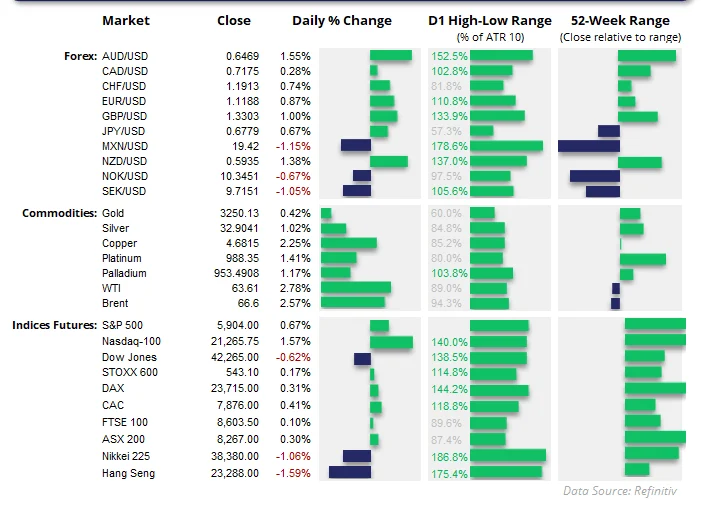

Australian Dollar Technical Outlook

The AUD/USD pair broke above its 200-day moving averages and formed a bullish engulfing candle, a sign of strength. The next key level to watch is 0.6515, the high from March.

Other AUD Pairs:

- AUD/CAD rose 1.2%, testing resistance at 0.9040.

- AUD/EUR hit a 28-day high but faces resistance near 0.5800.

- AUD/CHF climbed above 0.54 as traders moved away from safe havens.

- AUD/JPY gained again, with a potential breakout above 96.00.

- AUD/NZD continued its rally, reaching a 24-day high.

AUD/USD at a Crossroads

The strong upward move in AUD/USD puts the pair close to its May high. However, continued gains may depend on further strength from Wall Street and the yuan. If these markets slow, the AUD/USD could face a false breakout before making a more sustainable move.

Also, signs of bearish divergence on the RSI suggest the rally may be losing steam in the short term.

USD/CNH Analysis: Yuan Could Pull Back

The USD/CNH pair (US dollar vs Chinese yuan) has fallen for three days, reflecting yuan strength. But Tuesday’s “spinning top” candle hints that this trend may slow. Technical indicators like bullish RSI divergence suggest a small rebound in USD/CNH could be coming.

If the yuan weakens, this could put pressure on AUD/USD and trigger a short-term pullback.